We have set up a secure online portal for your convenience and security so that your can:

Please note that we have a portal account for each taxable entity. This means you need a different username for each.

Here are some screenshots of the portal once you login:

- request a services and upload your tax documents and download your tax returns securely

- create and monitor service requests online - including your tax preparation process

- Upload additional documents as requested by your tax preparer

- view your bills and easily pay your account

- update your personal information like addresses , phone numbers and emails.

Please note that we have a portal account for each taxable entity. This means you need a different username for each.

Here are some screenshots of the portal once you login:

1. Request a service, monitor progress and upload documents:

Our workflow is managed through "Service Orders".

You can Request Service by creating a service order as show below. You can add notes, set delivery preferences, and upload documents here.

You can Request Service by creating a service order as show below. You can add notes, set delivery preferences, and upload documents here.

2. SUBMIT DOCUMENTS TO AN EXISTING WORK ORDER

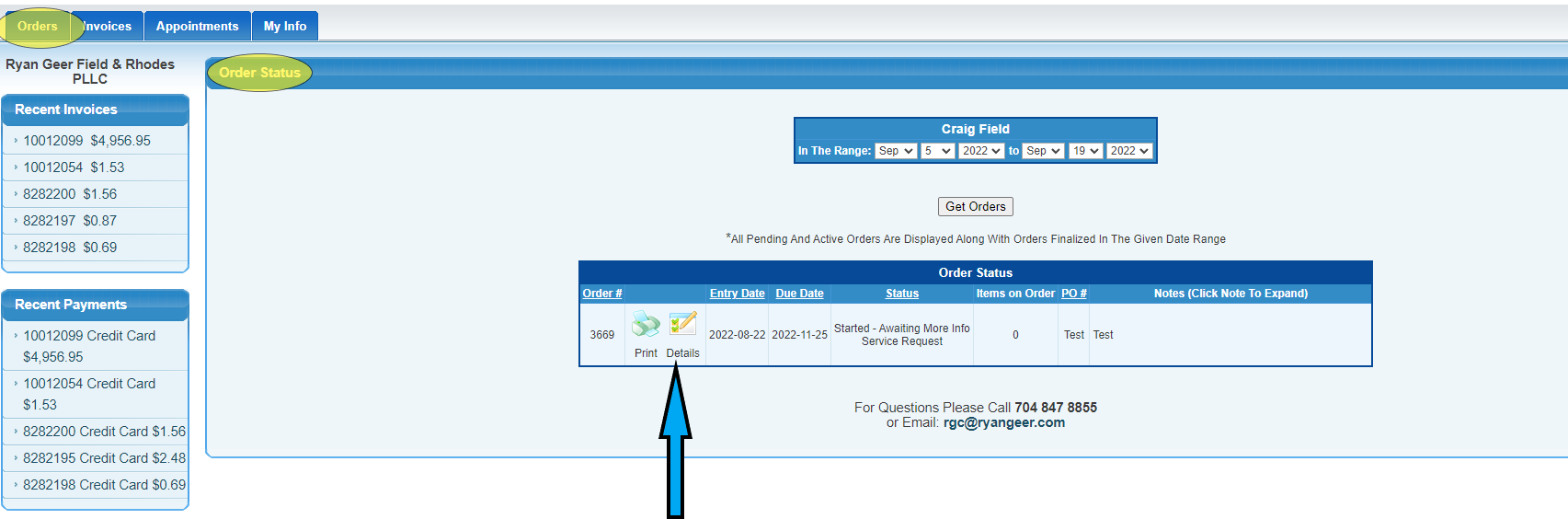

Once a Service Order has been established monitor progress and follow up on the Order Status page. Click on Details to submit additional documents:

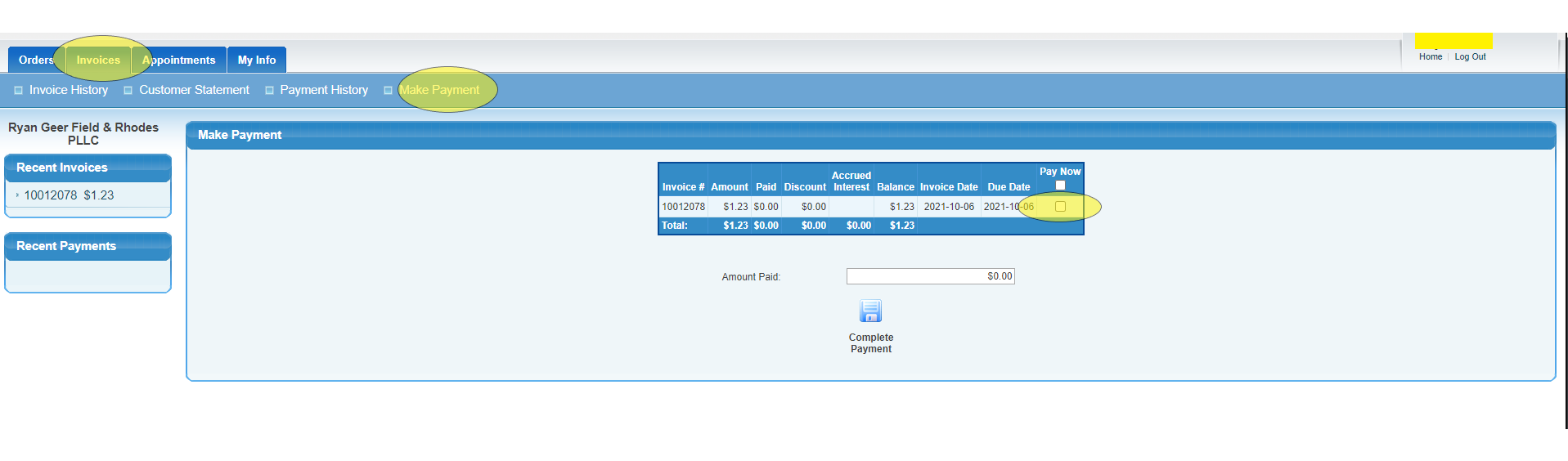

3. Easily pay bills online

You can check your payment history and any outstanding invoices under the Invoices tab. We require payment prior to e-filing tax returns and this can be done here using a credit or debit card:

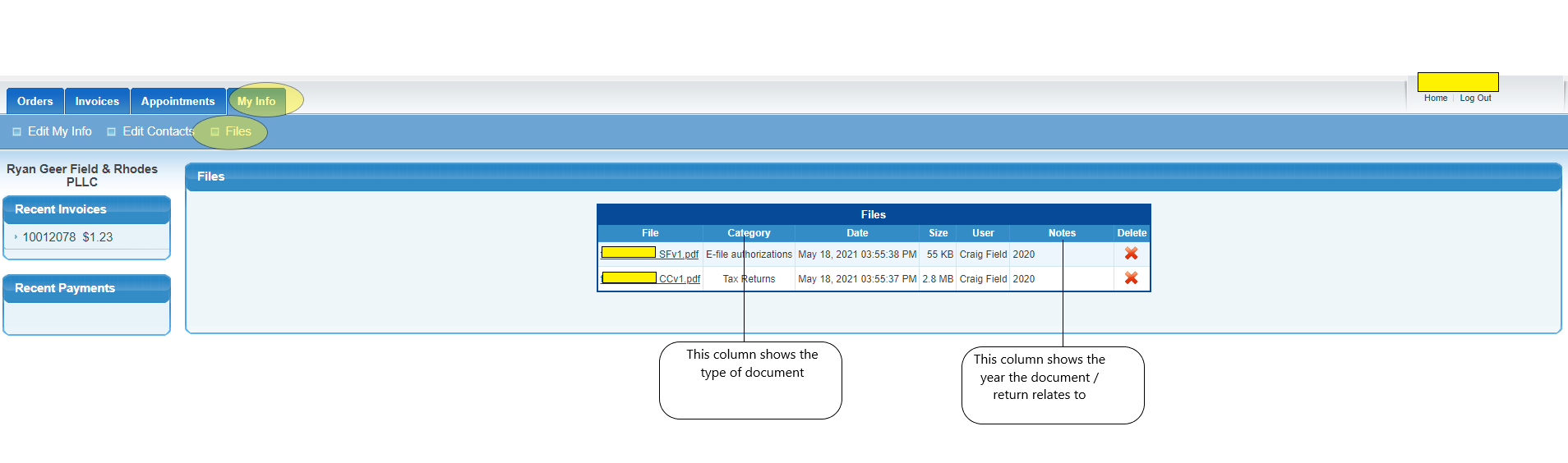

4. Download past tax returns and keep us up to date

Keep us up to date with your last contact information under the My Info tab.

View your tax returns and other sensitive documents by going to the My Info tax. IRS Circular 230 prohibits us from sending any sensitive documents (those with SSN's) via email because of the risk associated with emails. Use the Category and Notes columns to determine or find what you are looking for. You can also:

- Update your personal information - we use this to make sure we have the correct information in your tax return

- Add contacts we can talk to if your are not available

* - password reset is dependent on our smtp link with Google working. For security reason they sometimes reset the smtp access so if this happens please call the office at 704 -847 8855 to assist.